About Bill Nelson Real Estate Group

Wiki Article

Rumored Buzz on Bill Nelson Real Estate Group

Table of ContentsGetting The Bill Nelson Real Estate Group To WorkSome Of Bill Nelson Real Estate GroupEverything about Bill Nelson Real Estate GroupTop Guidelines Of Bill Nelson Real Estate GroupThe Bill Nelson Real Estate Group IdeasBill Nelson Real Estate Group - An Overview

You're not interested in month-to-month rental fees when turning a home. Instead, you need to acquire a home for the most affordable feasible rate if you want to make a great earnings when marketing.

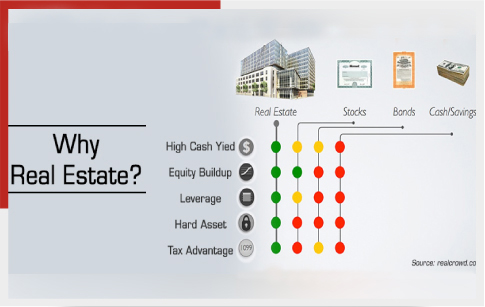

Expanding your financial investment profile is important. If you put all your eggs in one basket, you can suffer an overall loss in the blink of an eye. But when you invest some funds in the supply market, various other funds in bonds or ETFs, and also some in realty, you boost your possibilities of higher revenues as well as less losses.

The Basic Principles Of Bill Nelson Real Estate Group

Neither is accurate, and also to comfort you, here are 8 great reasons that property is an excellent financial investment. The Leading Reasons Property Is a Good Financial investment If you're thinking of buying property, you will start one of the most effective investment journeys of your life time.There aren't way too many other investments that allow you to purchase properties worth a lot more than you need to invest. For instance, if you have $10,000 to purchase the stock exchange, you can usually buy simply $10,000 worth of supply. The exemption is if you spend for margin (obtain), however you have to be an accredited financier with a high internet well worth to make that take place.

Allow's claim you discovered a home for $100,000; if you put down $10,000, possibilities are you can locate a financing to finance the remainder as long as you have excellent credit score and steady revenue. With that, it suggests you invest just 10% of the property's worth and own it.

Getting My Bill Nelson Real Estate Group To Work

Unlike supplies or bonds, you can compel the real estate to value. On average, genuine estate values 3% 5% a year without you doing anything except maintaining the home.You will not get a dollar-for-dollar return on your investments, yet some restorations can pay you back as high as 80% 90% of the cash spent. The remodellings don't have to be significant either. Naturally, including an area or completing the basement will certainly add even more value than basic cosmetic improvements, however even small kitchen area and also washroom renovations can significantly impact a residence's well worth.

While it's an investment, when you own a house and lease it out, you run a service you are the property owner. As the company proprietor, you can usually compose off the following expenditures: The home loan rate of interest paid on the financing Origination factors paid on the car loan Upkeep expenses Depreciation (expanded over 27.

The 8-Second Trick For Bill Nelson Real Estate Group

When you purchase supplies or bonds, you can only write off any type of funding losses if you market the asset for less than you paid for it. bill nelson real estate group. If you buy and hold property, you can earn regular monthly capital browse around here renting it out, and this raises the benefit from having actual estate given that you aren't depending just on the gratitude yet the regular monthly rental revenue.Roofstock Industry is a fantastic source. They not only checklist offered my explanation financial investment houses to buy, yet a lot of them have lessees with leases in position currently. When you acquire the residence, you instantly become a property owner. Roofstock additionally offers a lot of due diligence, researching you, so all you have to do is get the residential or commercial property you assume is ideal.

There's not much to feel protected about when you spend in the market. When you invest in actual estate long-term, you know you have a valuing property.

Bill Nelson Real Estate Group for Beginners

Many individuals invest in property to supplement their retirement income. Whether you own the home while you're retired, making the regular monthly rental money circulation to supplement your earnings, or you offer a home you've owned for several years when you remain in retired life and also earn a profit, you'll raise your retired life income.

If buying property as well as renting it out is as well demanding for you, there are numerous various other means to buy property, including: Acquire an underestimated residential or commercial property, fix it up and also flip it (repair as well as flip) Be a wholesaler functioning as the middle man in between motivated sellers and a network of customers.

Buy an Actual Estate Financial Investment Count on If you desire to leave a tradition behind but don't assume going money is a great concept, passing genuine estate down can be even informative post better. Not just will you provide your beneficiaries an income-producing possession, however it's likewise an appreciating property. They can either keep the property as well as allow the tradition proceed or sell it as well as gain profits.

Not known Factual Statements About Bill Nelson Real Estate Group

While there's not a one-size-fits-all answer, there specify credit to search for when you purchase property, including: Try to find an area that's eye-catching for renters or with fast appreciating homes. Ensure the area has all the amenities and conveniences most property owners want Take a look at the location's crime rate, institution rankings, as well as tax background.

Report this wiki page